The Consequences of Incorporating

There are four major ways a family child care provider can operate her business: sole proprietor, partnership, limited liability company (LLC), or corporation. The vast majority of providers set themselves up as a sole proprietor (a self-‐employed business). Deciding what business structure to operate under is an important and complex decision.

In the end, after taking into consideration all of the factors in this decision, we believe that for the vast majority of providers the best decision is to operate as a sole proprietor. We strongly recommend that providers who are considering a business entity other than a sole proprietorship should consult an attorney and a tax professional before making this decision.

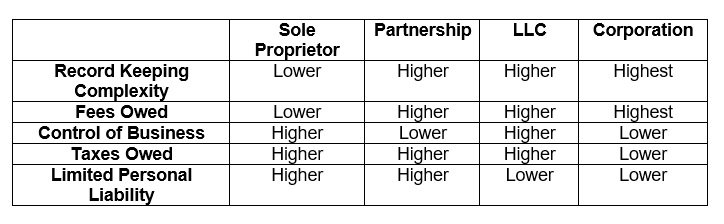

Here is a summary of the five major factors that you should use in evaluating your business entity decision:

The issue of limited liability is complicated. Providers who purchase adequate business liability insurance should be able to protect themselves from most business risks. Although there is somewhat more personal liability protection when you incorporate, it is necessary to keep careful records and follow many corporate formalities to obtain this protection. We believe that unless a provider has a business profit of more than $30,000 and significant personal assets that need protection, it is not necessary to choose any other business entity beside a sole proprietorship.

Tom Copeland -‐ www.tomcopelandblog.com