The Tax Benefits of Becoming a Regulated Family Child Care Provider

It is a federal law that every child care provider earning money by caring for children in their home must report their income to the IRS. Many providers do not report their income either because they aren’t aware of the tax laws or because they are worried that they will owe too much in taxes.

This handout shows how all providers can significantly reduce their taxes. For federal tax purposes, a child care provider falls into one of two categories:

A provider who does not meet their state regulations is called an unregulated provider. An unregulated provider is someone who is required to meet state standards (such as licensing or registration) but does not. Although we do not recommend being unregulated, such providers should be aware that they can take many business tax deductions if they report their income.

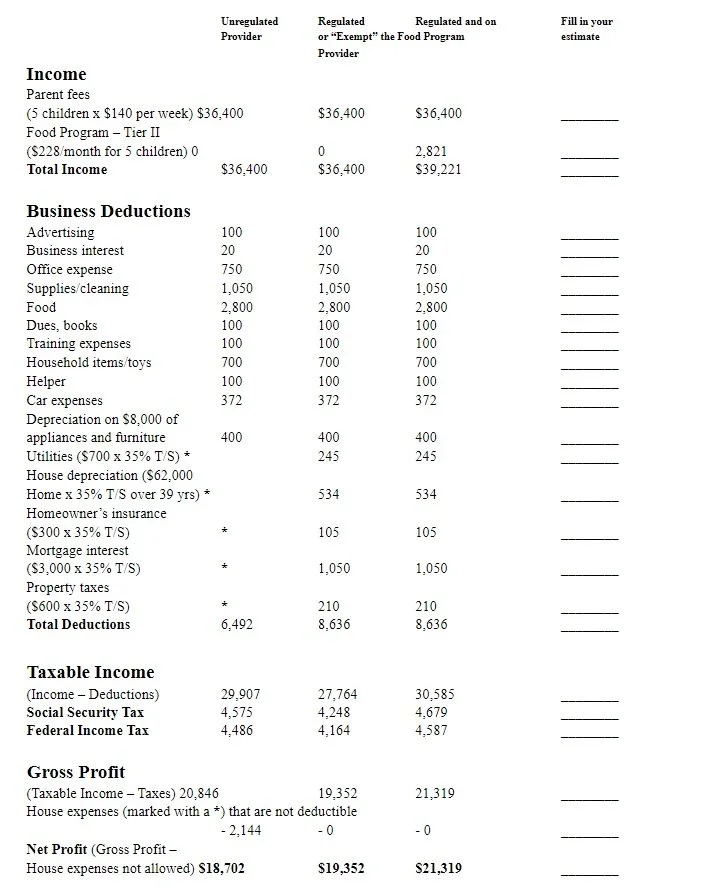

See column one of the chart. Taking deductions can greatly reduce any taxes owed.

A provider who does meet their state regulations, is called a regulated provider. A regulated provider is entitled to claim house expenses in column two (house depreciation, insurance, mortgage interest, property taxes, and utilities) that an unregulated provider cannot claim. A provider who is exempt from state regulations is entitled to all the same deductions as a regulated provider, but is usually not eligible to participate on the Food Program. Regulated providers can increase their net profit by joining the Food Program (see column three).

Besides claiming additional tax deductions, there are many other benefits of becoming a regulated child care provider. You can:

Join the Food Program and be reimbursed for some of your food expenses.

Obtain business liability insurance to protect your business.

Join a local association of family child care providers and receive the benefits of membership.

Sign up to be listed by your local Child Care Resource and Referral agency that will refer parents to your business.

Attend training workshops and receive other support services.

Become eligible for local grant and loan programs in some areas.

This chart shows how three providers with identical expenses can have a very different net profit depending upon whether the provider is regulated or joins the Food Program.

Notes on the chart: The numbers in the chart are only estimates shown for comparison purposes. Your income and expense will vary. Not all the business deductions or tax consequences are shown on this chart. We used a 35% Time/Space percentage (T/S) representing the portion of the home used for business. We used a 15% federal income tax rate. Notice that the deductions are the same for each provider, except that the unregulated provider cannot claim expenses associated with the house (marked by a *). By losing these deductions, this provider pays more taxes. These deductions (totaling $2,144) are subtracted from the unregulated provider’s gross income because the provider had to pay these expenses anyway, even though they are not allowed as a business deduction.

Also notice that an exempt provider (one who is not required to meet local regulations) can claim all of the same deductions as a regulated provider. The provider on the Food Program pays more taxes, but has the highest net profit. Every provider is better off by joining the Food Program.

Tom Copeland